2022 Bonus Depreciation Cars

2022 Bonus Depreciation Cars

The IRS sets different. The safe harbor allows depreciation deductions for the excess amount during the recovery period subject to the depreciation limitations that apply to passenger automobiles. IRS finalizes regulations for 100 percent bonus depreciation. Property Type Building Price.

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

18200 for the first year with bonus depreciation.

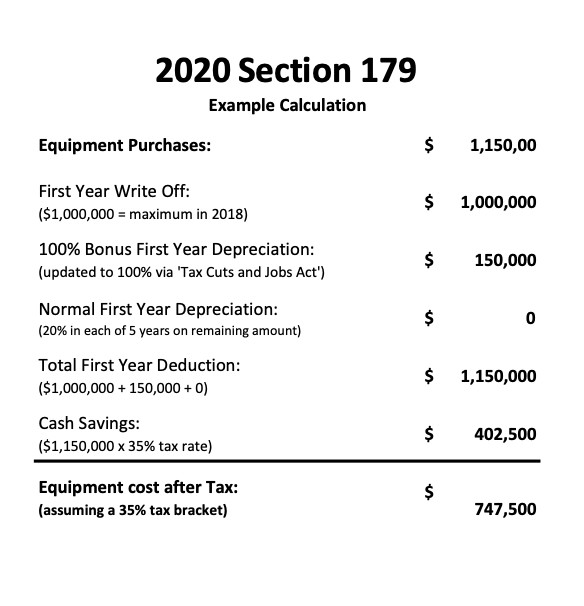

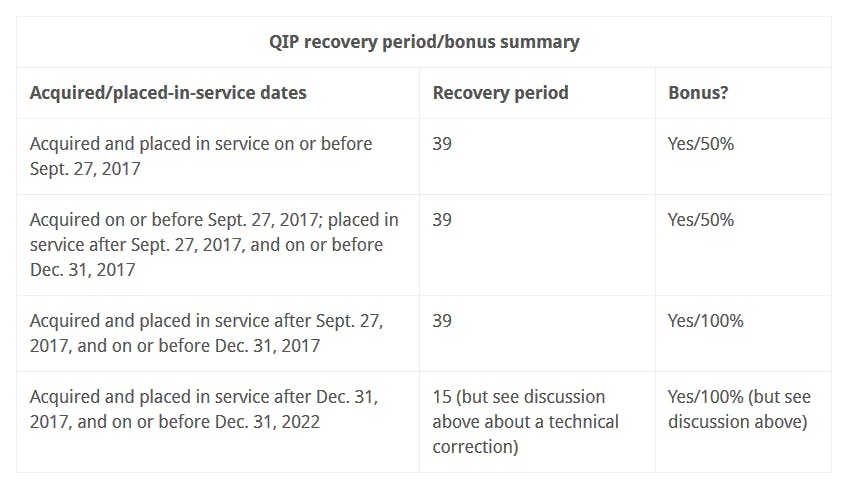

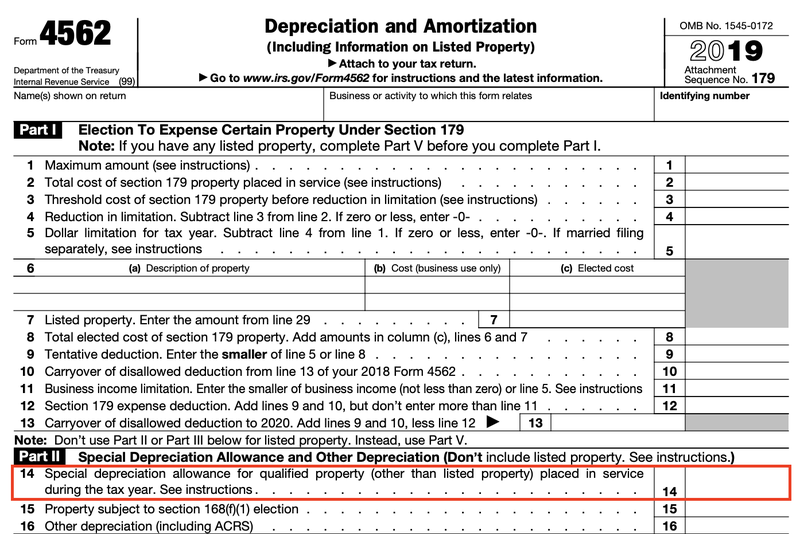

2022 Bonus Depreciation Cars. Starting in 2023 the rate for bonus depreciation will be. For qualified property acquired and placed in service after Sept 27 2017 and before Jan 1 2023. Bonus depreciation is a way to accelerate depreciation.

The 100 bonus depreciation amount remains in effect from September 27 2017 until January 1 2023. 8000 increase in first-year cap if bonus depreciation claimed. Bonus depreciation can deliver serious tax savings for your small business.

Year 1 deduction 2021 using 100 bonus depreciation 18200 Remaining basis of the car 41800 MACRS depreciation 2022 Table 5 year 2 five-year assets 32 13376. 27 2017 and before Jan. The safe-harbor method does not apply to a passenger automobile.

Need A New Business Vehicle Consider A Heavy Suv Fmd

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

2020 Section 179 Commercial Vehicle Tax Deduction

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Section 179 Deduction Hondru Ford Of Manheim

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Save With The Section 179 Tax Deduction In Bismarck

Irs Issues 2017 Car And Truck Depreciation Limits Journal Of Accountancy

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

What Is Bonus Depreciation A Small Business Guide The Blueprint

Section 179 Tax Exemption Bentley Pasadena

Tcja Changes Deductions For Vehicle Expenses Depreciation

Vehicle Deduction 2019 First Year Depreciation Breaks West La Cpa

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Need A New Business Vehicle Heavy Suvs Have Tax Benefits Landmark

Bonus Depreciation Safe Harbor Rules Issued For Vehicles And 4 Other Tax Provisions Business Owners Need To Know About Using Their Cars For Work

Safe Harbor For Luxury Autos And Bonus Depreciation Provided By Irs Current Federal Tax Developments

Post a Comment for "2022 Bonus Depreciation Cars"