Depreciation Limits For Cars And Trucks 2022

Depreciation Limits For Cars And Trucks 2022

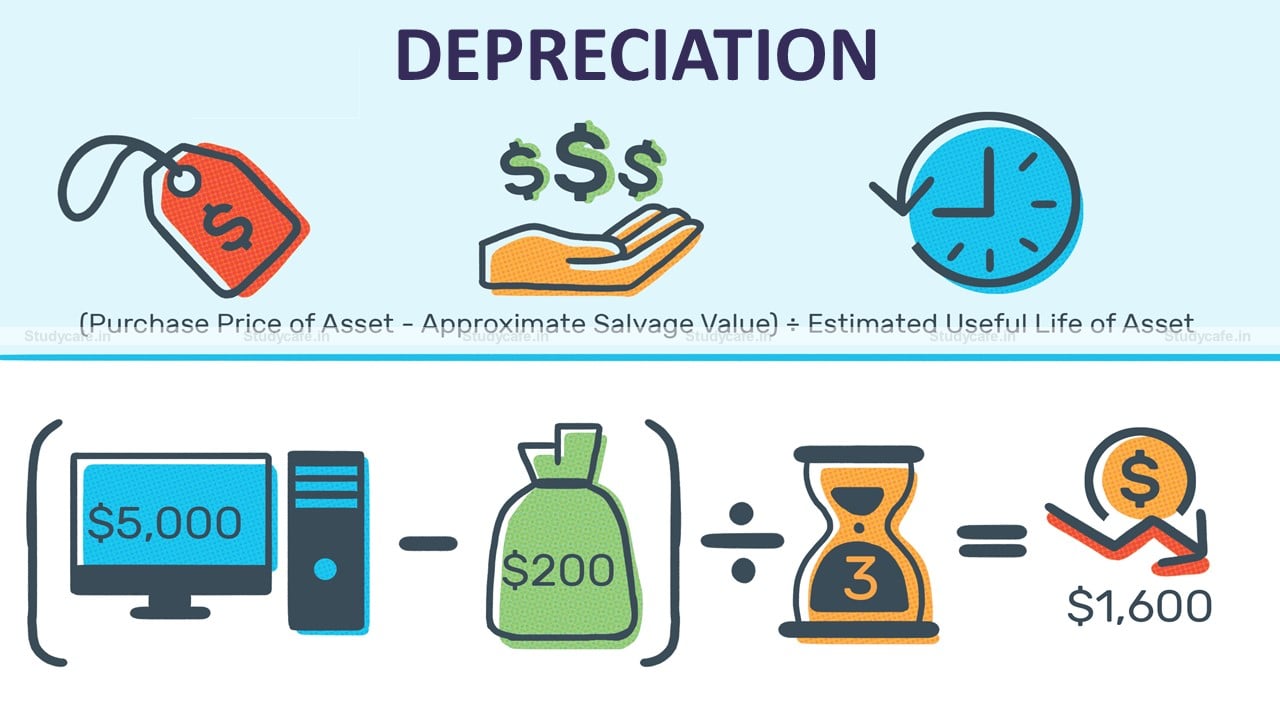

The following depreciation limits apply indexation calculations courtesy ATO. The recent tax reform substantially increased these limits by providing much larger first- and second-year deductions for more expensive vehicles. During 2018 through 2022 you may deduct in a single year up to 100 of the cost of most types of personal property you use for business with bonus depreciation. So when you buy that 40000 car in 2018 through the end of 2022 compare the example above you can actually write-off 89 of the car in the first 3 years PLUS.

Rates Of Depreciation For Income Tax For Ay 2022 23

Changes to depreciation limitations on luxury automobiles and personal use property.

Depreciation Limits For Cars And Trucks 2022. The 100 deduction applies to purchases made in 2021 and 2022 and will start to decrease each year until it hits 20 in 2025. For passenger automobiles to which no bonus first-year depreciation applies the depreciation limit under Sec. If property was acquired prior to September 28 2017 but not placed in service until after September 27 2017 then prior year rules will continue to apply.

16100 for the second tax year. They are however limited to a 25000 IRC 179 deduction. But dont exceed 14000 lbs qualify for withholding up to 25000 if the cartruck is acquired and placed in service prior to Dec 31st and meets all other IRS qualifications.

27 2017 and placed in service during calendar year 2020 the depreciation limit under Sec. Before you could only deduct 50 of an assets cost upfront using this break. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or.

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

New Higher Rate Of Depreciation On Motor Car

Irs Updates Car And Truck Depreciation Limits Journal Of Accountancy

Limitation On Luxury Automobile Depreciation Depreciation Guru

Irs Issues 2017 Car And Truck Depreciation Limits Journal Of Accountancy

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

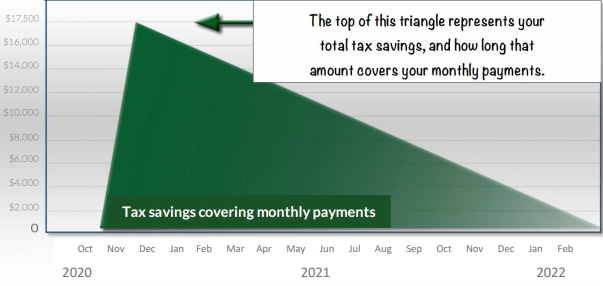

Gm Tax Savings In Stockton At Mataga Buick Gmc

Section 179 Tax Deduction Explained Alpharetta Ga Near Sandy Springs Cumming Gwinnett Duluth

How To Beat Car Depreciation Kelley Blue Book

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Section 179 Tax Deduction For Vehicles

Tax Deductions For Small Businesses Write Off Up To 100

Tcja Changes Deductions For Vehicle Expenses Depreciation

Vehicle Deduction 2019 First Year Depreciation Breaks West La Cpa

Post a Comment for "Depreciation Limits For Cars And Trucks 2022"